Most business owners want to grow their business, generate more sales and make more money. Marketing can help you do this … but not always.

One costly mistake that I’m increasingly seeing business owners make is spending money on marketing activities before optimising their financial model. When this happens all sorts of bad stuff can happen and in a worst-case scenario it results in selling more stuff but losing more money.

More sales - Less money?

Recently I worked with a business owner that had invested significantly in Facebook ads over the previous 12 months. This increased his revenue but made no impact on his profit. What we discovered was that the ads were attracting new clients to buy an unprofitable service. The real problem however was that my client didn’t know this service was unprofitable. This was because he didn’t understand his financial model.

Fixing this problem wasn’t difficult and you can find some tools we used to achieve this later in this article.

Less sales – more money?

Part of the answer to fixing the problem was to improve some inefficient processes and stop servicing smaller and unprofitable clients. Although the business owner recognised that this made sense it was difficult for him to do because most of us are hard-wired to believe that growing your business is all about growing your sales.

The reality is that business growth is only worthwhile if it results in more cash ending up in your bank account. That why there’s truth in the old saying that Sales = vanity, Profit = sanity and cash = reality. Cash is the lifeblood of your business and focusing on sales without regard for profit and cash is simply bad business management.

More sales – more money?

Its surprising how many business owners say they’ve accepted sales just to keep busy. I’ve seen numerous instances when they justify this on the basis that they’re at least breaking-even. Unfortunately there’s a difference between breaking-even on a job and breaking-even as a business. There’s often also a difference between the amount of profit you make and the amount of cash that ends up in your bank account. If you don’t understand your financial model it’s unlikely you’ll understand these differences and it’s even more unlikely you’ll be able to fix them.

But if you do understand your financial model you’ll be in a position to optimise it This means more sales = more money and your business can become the well-oiled money-making machine you always wanted

The Big discount scam

It’s worth going down this rabbit hole because it’s often preceded by marketing. I call it a scam because discounting your prices can easily mean scamming yourself – not your customers. Too many businesses advertise discounted prices to try win more sales and make more money. This can work but it is a dangerous game, even if you understand your financial model. There’s a place for discounting (e.g. disposing of old stock) but it can easily result in less profit even if it significantly increases your revenue. This video explains why.

It's not just about sales and profit margins

It’s important to understand that your financial model doesn’t stop at sales and profit margins. It also reflects how efficient your general business activities and processes are. If your business is inefficient (and no business is 100% efficient) you’re incurring unnecessary costs and time. This means more stress to you, your staff and your customers and less profit and cash from your business.

There’s little point in pushing even more work (sales) through an already stressed, inefficient or broken system. If you want to make some immediate long-term improvements to your profit and cashflow by identifying and fixing inefficiencies, you could read this article.

How to identify the profit potential of your business

One quick way to get an insight into the profit potential of your business (with or without marketing) is to do some simple sums on the back of a cigarette box. Yep it really shouldn’t be rocket science and this video shows how most business owners can achieve this. It shows how a business with $1.0million sales increased its $100K profit before tax by 50% just by making four 2% tweaks to its financial model.

This stuff is real but lots of business owners miss it because marketing appears more sexy than investing a little time in understanding their numbers.

How to work out the extra sales required to pay for your marketing

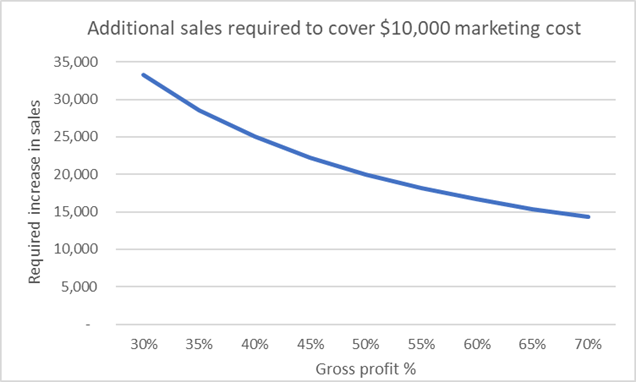

In the excitement of increasing your sales to make more money, it’s easy to forget that before you make any additional profit you need to make additional sales to pay for your marketing. The graph below shows the value of sales required to pay for $10,000 marketing for a range of Gross Profit margins.

You can work out this number in your own business by dividing the marketing cost by your GP%. If you don’t know how to calculate your GP%, or are unsure of its accuracy, this video could help.

A question you must ask your marketer

Remember that Sales = vanity, Profit = sanity and Cash = reality. I’m not going to discuss cashflow in this article but making a profit from your marketing activities in one step closer to generating cash than making a sale. This is why you should ask your marketer to explain how much additional profit you will make rather than how much additional sales.

And if your marketer can’t or won’t take the time to look at your financials and understand your profit model, you should perhaps talk to someone who will. That way you’ll identify opportunities to increase the profit from every sale you make, regardless of whether you grow your revenue.

How to avoid the big marketing mistake

So the big marketing mistake is spending money on marketing before you maximise the efficiency of the money-making machine that should be your business.

Don’t get me wrong, everyone needs marketing but more importantly everyone needs a viable financial model through which to generate those sales. Don’t make the mistake of thinking that a good product/service plus some good marketing will make you successful. It won’t. You need to understand your numbers too.