Eleanor Roosevelt once said "Learn from the mistakes of others because you don't have time to make them all yourselves".

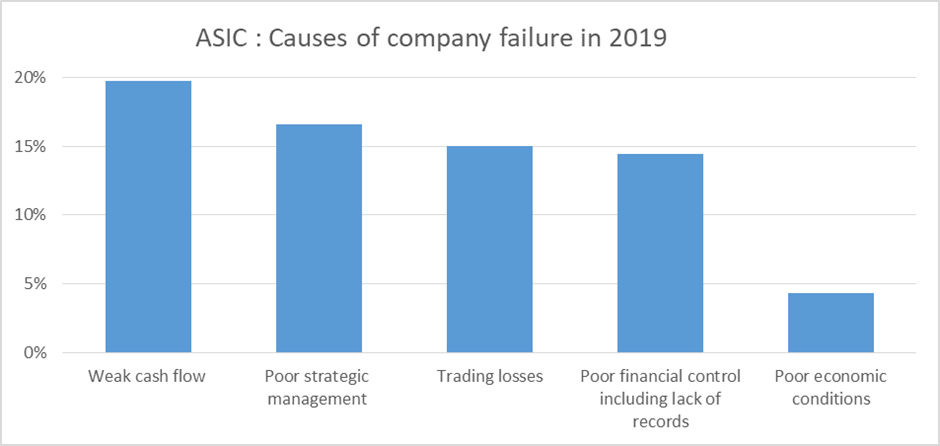

Every year ASIC publishes the reasons for the 8-10,000 Australian business failures and the pattern is remarkably consistent. What you may find surprising is that a weak economy is not a major factor. Most years it only contributes to about 5% of business failures and this has been the case for the past ten years.

OK, I know what you’re thinking:

“We can’t control the economy - what we’re currently experiencing is something that none of us have ever experienced before. For many of us the economy is making life really tough”.

I agree.

But we can still learn from the past, especially if we want to make a better future.

While it’s true that the economy is something you can’t control, and it’s a factor that obviously has an impact on business performance, the economy can be too easy to blame if sales are down, profits are low or if there never seems to be enough cash to carry you from month to month.

What ASICs data also tells us is that the top four reasons for business failures are also consistent and they are all things that you can control.

This is because they’re things that reflect the way you manage your businesses. They are:

• Poor cash management

• Poor business planning / implementation

• Trading losses caused by weak sales processes, poor pricing & poor/cost control

• Poor financial control generally, including lack of records

What I believe, and this has been learned from working with hundreds of small businesses, is that while you have to juggle a lot of balls, you basically only have to manage three. You have to:

1. Provide a beautiful product or service.

2. Be able to sell that beautiful product or service. and

3. Understand your numbers if you want to make good money.

What I have also learned is that Number 3 is the biggest challenge for most small business owners. For some reason many just don’t want to do it. They think that working harder and focusing on the tools is the key to success.

To be clear, what I have also seen is that well managed businesses consistently make more money than businesses that are less well run.

In fact in tough times it’s the well managed businesses that survive – and sometimes even thrive – and when the good times roll, it’s the well managed business that roll with them. All the way to the bank…..

So if things are tough for you – and even if their not – maybe you should invest time in understanding your numbers. There’s a lot more to them than a P&L and a balance sheet and none of it is rocket science.